Local Buying Tips

Home

10 Things to Know Before Purchasing Your First Home

Buying your first home is a big investment – one that can affect your lifestyle and your credit. The more information gathering you do before making your decision, the greater your satisfaction is likely to be before, during and after your move. To get you started, here are ten things to know before buying your first home.

- How much you can afford: Consider all costs involved, including the down payment, closing costs, your monthly mortgage payment, taxes and maintenance, insurance and any applicable association fees.

- Your credit score: Credit is an agreement to borrow money with the promise that you will pay it back later through scheduled payments. Good credit may get you a lower rate on your loan. To learn about credit and how to get your score, read our “All About Your Credit” article.

- The home-buying process: From the pre-approval decision through inspections and the closing, the home-buying experience involves many steps. Make sure you see the big picture before you start by reviewing the Home Purchase Checklist.

- Your financing options: Rates, terms, discount points and other details vary by loan type and with your credit. If you’re ready to take the next steps, find out what’s available to you by calling (866) 256-4621 to discuss your options.

- The right real estate agent for you: Real estate agents specialize in a variety of areas and are each familiar with different neighborhoods. Choose one who you feel best aligns with your needs and personal preferences.

- The neighborhood: Safety, commute times, noise and other surrounding factors can influence your quality of life. Make sure you visit the area, walk around the neighborhood and get a feel for the community. Take the time to research the community online to learn of any upcoming developments that may impact the housing market in that area, and look for other red flags that may impact your choice to live there.

- The school district: Even if you don't have children, you should consider the rating of the school district where you are planning to live. The school district where your home is located will have a direct impact on your taxes and could influence who your neighbors are. And while low taxes may seem appealing because you don't have children, strong school districts are a top priority for many home buyers, so this can help to boost your property value and your bottom line when you choose to sell. It’s important to weigh the pros and cons for your situation now and in the future.

- The state of the market: Is it a buyer’s or a seller’s market? Can you get more house for less if you wait a little longer? Timing can be crucial in determining the total cost of your first home.

- Comparable prices: How much do similar homes in the surrounding area cost? You may want to compare houses in several neighborhoods to make sure you’re getting a good value. Ask your real estate agent for information about comparable properties (or “comps”) to determine how much to offer.

- How your taxes will change: While home ownership comes with additional expenses like taxes and interest fees associated with your mortgage, you may be able to deduct your mortgage interest and real estate property taxes come tax season. Consult with your tax advisor for details specific to your individual situation.

Home OwnerShip is the key to building wealth

For years, real estate has been considered the best investment you can make. A major reason for this is due to the net worth a household gains through homeownership. In fact, according to the 2019 Survey of Consumer Finance Data from the Federal Reserve, for the average homeowner:

“…a primary home accounts for 90% of the total wealth of a family in the U.S.”

How do homeowners gain wealth?

Most large purchases, like cars and appliances, depreciate in value as they age, so it’s understandable to question how owning a home can increase wealth over time. In a simple equation, the National Association of Realtors (NAR) explains how the combination of paying your mortgage and home price appreciation grow overall wealth:

Principal Payments + Price Appreciation Gains = Housing Wealth Gain

As home values increase and you make payments toward your home loan, you’ll gain wealth through equity. The same article from NAR also addresses how wealth gains tend to play out over time:

“Housing wealth accumulation takes time and is built up by paying off the mortgage debt and by price appreciation. And while home prices can fall, home prices tend to recover and go up over the longer term. As of September 2020, the median sales price of existing home sales was $311,800, a 35% gain since July 2006 when prices peaked at $230,000.”

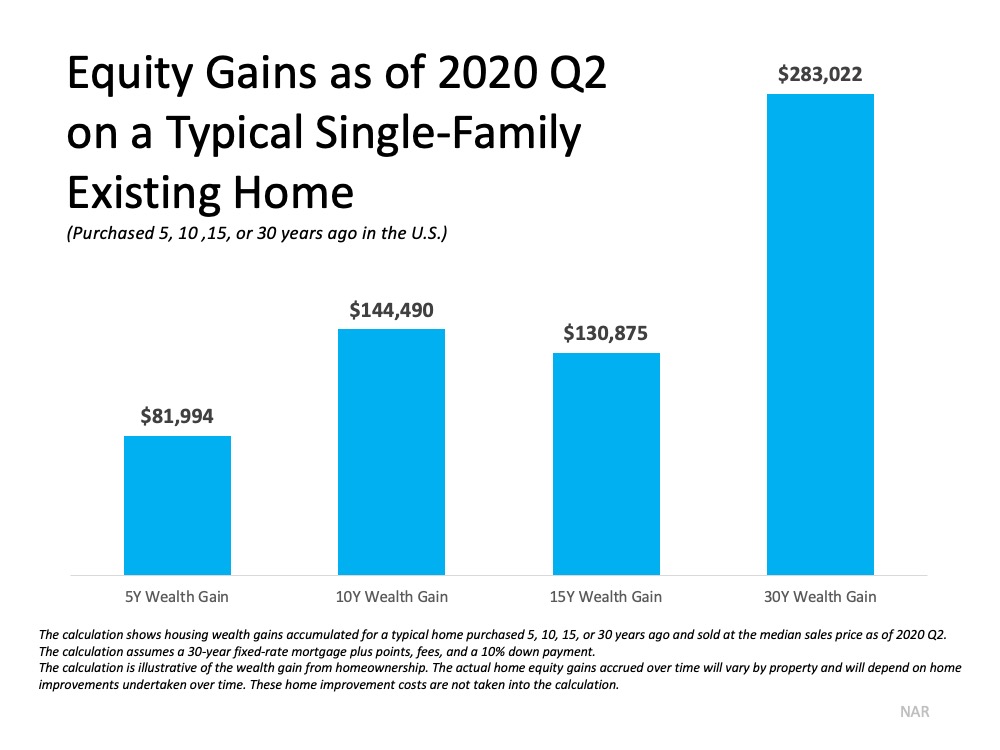

Taking a look at how equity has grown for the typical homeowner, it’s clear to see how real estate is a sound long-term investment. NAR notes:

“Nationally, a person who purchased a typical home 30 years ago would have typically gained about $283,000 as of the second quarter of 2020.” (See graph below):

Bottom Line

Whether you’re a current homeowner planning to put your equity toward a new home or have hopes of buying your first home soon, homeownership will always be a great opportunity to build your net worth and overall wealth. Owning a home is truly an investment in your financial future.